With summer winding down, it’s a good time to look forward and discuss both economics and politics as we move toward 2024.

August was a difficult month for stocks and bonds. August was tough for stocks and bonds due to heavy bond issuance, fewer foreign treasury buyers, and inflation concerns, impacting interest rates and stock values. But still, the retreat was orderly for both asset classes. We think we are close to the end for bonds at above 4.5% on the 10-year, we will see increased pressure on all things real estate, and automotive loans will come under greater origination pressure. Interest rates have not hurt home prices yet only because supply has collapsed. Sixteen years of extremely low rates means a large percentage of the housing stock is controlled by owners with mortgage rates less than half of current ones. So, housing prices haven’t reacted to a rising rate cycle as they have historically. The few homes for sale are gobbled up by cash buyers as there remain more buyers than sellers.

Rising interest rates will impact, even if delayed. Small business loans will become costlier, likely weakening C&I loan demand as banks predict, possibly cooling the job market. It was tougher for 2023 college graduates to find jobs compared to 2022, though unemployment stats don’t reflect this yet.

We think the next several months’ inflation prints will be benign, and we will be surprised if CPI doesn’t start with a “2” by the fall. Therefore, we believe the Federal Reserve will not have any ammunition to raise rates this fall, giving a modest boost to market sentiment.

Like Jay Powell, we are not convinced that inflation is permanently slayed. We agree that service inflation may prove less transitory than goods inflation. It is quite possible, if we avoid a recession that inflation could tick back up in 2024. But that is a 2024 story, and we believe that the inflation news will be good in 2023. We expect both stocks and bonds to rally modestly into year-end on this data, all things being equal.

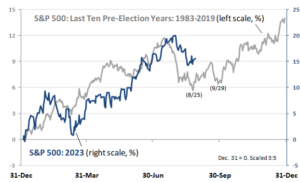

Seasonally, the fourth quarter before an election year is historically strong.

The graph from Oppenheimer & Co. displays the average performance of a president’s third year since 1983. Despite mediocre summer returns, there’s typically a fourth-quarter rally. This trend remains despite varied economic scenarios over 40 years.

Unlike interest rates, we thought we would devote the rest of this commentary to two topics very much on the back burner in investors’ minds now. There’s potential for a government shutdown in the coming months as conservative Republicans assert themselves. With Trump not in office, they might more openly challenge fiscal spending.

Typically, government shutdowns are positive for the market; however, it will likely greatly impact the economy around Washington, DC, as federal workers aren’t paid during a shutdown. But most of the US will chug along and not notice. Usually, a shutdown lasts for a few weeks before a deal is orchestrated. Both parties want to avoid economic harm, but face a dilemma: the public believes spending is high yet opposes program cuts. This makes austerity challenging. Without enough Senate votes for significant cuts, even if Trump returns to office, it’s unlikely the Inflation Reduction Act will be repealed. Despite contrasting public opinions, government spending will stay stimulative due to the national debt’s interest implications.

The upcoming Presidential election suggests an early candidate selection ahead of the New Hampshire primary, hinting at a Trump-Biden rematch. Both face the challenge of mobilizing their bases and appealing to suburban voters in key swing states, which could determine the outcome.

The Trump base is rural with a growing small business enthusiasm due to his personality and the good economy pre-Covid. The Biden base is urban, union workers and a variety of people who, for lack of a better term, don’t like Trump’s style. A key factor this season is Trump’s potential four jury trials, which could rally both bases: Trump’s supporters feeling targeted and Biden’s, fueled by regular CNN coverage, seeing Trump as a threat.

While it is necessary to turn out the base, winning the moderate suburbs in Atlanta, Philadelphia, Detroit, and Phoenix is also necessary. These were the counties that decided the last election as they swung massively to Biden compared to 2016. No doubt, many of those voters were more anti-Trump than pro-Biden. But will it be enough in 2024 to run against Trump in those counties? We think both party platforms will try to thread the needle of appealing to their respective bases but give something to these well-educated, wealthier, largely independent suburban counties, who are much less motivated by culture wars.

The good news is that we believe that both candidates can pivot to the center early in the contest, as the nominations are locked up before the first vote is cast. From the market’s point of view, this could be helpful, as the most extreme positions can be silenced. In general, these suburban counties are stacked with voters who have significant 401(k)s and care deeply about the economy. Once the base is secure, we think both candidates should try to articulate policies with which wealthier, suburban families can identify.

Can Trump and Biden maintain focus on key affluent communities? It’s uncertain. But, a short primary cycle and the electoral vote for virtually all states already baked in the cake make these few counties punch way above their relatively tiny voter weight. They are the swing votes in the very few swing states left in America. Just like the last election, the path to the White House leads through Bryn Mawr, Pennsylvania. Who would have imagined?

All opinions expressed constitute Spouting Rock Asset Management’s (“SRAM”) judgment as of the date of this article and are subject to change without notice. Statements made are not facts, including statements involving trends, market conditions and the experience of SRAM, are based on current expectations, estimates, opinions and/or beliefs of SRAM.

______________________________________________________________________________________________________

Rhys Williams, CFA

Rhys Williams, CFA

Chief Strategist & CIO, Opportunistic All Cap

Rhys Williams joined Spouting Rock Asset Management (SRAM) in 2019 and is the chief investment officer for the Opportunistic All Cap, the firm’s long short strategy.

Prior to SRAM, Rhys held a variety of roles at Columbia Partners including principal and acting chief investment officer. He also served as a member of the management committee, equity management team, team leader for the small cap portfolios, and managed the firm’s single-strategy hedge fund endeavor. Before Columbia Partners, Rhys was a senior vice president at Prudential Securities where he successfully managed small and mid-capitalization stock portfolios. He was also a journalist in the Moscow office of The London Sunday Times before joining Prudential. Rhys earned a BA from Duke University (magna cum laude) and an MA in International Economics from Johns Hopkins University. He also holds a CFA® designation.